The concept of IoT revolves around the connectivity of devices, for the transfer of vital data. These devices are everywhere, from mobile devices to wearables e.g. wrist watches, smart glasses etc. to washing machines and other house hold items.

Thanks to IoT technology has experienced the revolution of big data. Big data can then be analyzed and used to increase profit for companies and improving customer experience for their users.

Companies in the finance industry have taken this technology serious, and a large number already implement it. In this regard, it would be great to see how this technology impacts the powerful finance industry.

Security advancements:

It‘s the finance industry we are talking about here, and security needs to be at its peak.

Transactions can be much more secure as verification codes can be sent to IoT devices such as tokens. This helps tackle cases of unapproved transactions, as the user gets the code for transactions on the IoT devices given to him.

Asides tokens, IoT devices can also utilize our biometrics to improve security of financial transactions.

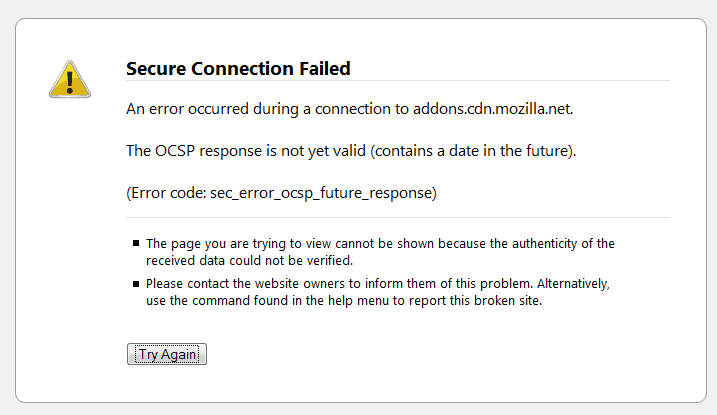

Truly IoT can help with increasing security during payments, however with the rise in cyber crime the risks being introduced by IoT need to be taken care of.

IoT is expected to increase the security of transactions, but it is left to see how the finance industry would battle hackers and their quest to take control of these devices.

Improved Customer Service:

A lot of users enjoy personalized attention from companies, and it is not different when financial companies are involved.

Organizations can take advantage of the huge data gotten from IoT devices, and then utilize this to make better decisions and improve customer experience.

Since IoT devices can be connected to mobile devices, they can be used to give users only the specific information they need on their phones after an analysis of the gotten data, building a profile for a user in the process.

Customers can even also get in touch with the customer service team, using their IoT devices.

A lot of this to ensure that negative interactions are stripped down to the minimum for users, providing a super experience.

Effective marketing:

Since IoT can help improve customer experience, companies are bound to take advantage of it in marketing strategies.

Users have their data stored in their devices in one way or the other, finance institutions can use this information to determine the best way to reach out to their potential customers.

Asides using IoT as a means of improving marketing, it can also be essential in knowing the needs of their users. This ensures that services or products are being rendered based on users needs not the organization‘s whims and fancies.

Risk management:

Fintech companies can take advantage of IoT to predict the risks of a relationship with an individual or another company.

An example can be seen with insurance companies, who perhaps have helped with insuring someone’s car or house.

With the information gotten from IoT devices in the house, deductions can be made when disaster occurs if it truly was an unavoidable disaster or one caused by the individual.

Same goes for vehicles, information on car’s use before an accident can be deduced, thanks to IoT.

Conclusion:

The internet of things is here to stay, and would be very critical in the finance industry. With it, users will operate from everywhere such as banking on their wearables; banks would also be able to use cars as a mobile banking branch and block-chain contracts would come into the picture.

IoT would definitely have great impact on the financial industry, it would be the “Finternet of Things.”

[custom-twitter-feeds feed=2]